Across the global chemical manufacturing landscape, a transformative shift is underway. Increasing numbers of companies are investing in advanced recycling technologies, particularly plastic pyrolysis, to turn plastic waste into valuable resources. With rising environmental regulations, growing public concern, and the push toward circular economies, the trend is clear: chemical producers are not just adapting—they are reinventing how plastics are managed and reused.

Global Momentum Behind Plastic Pyrolysis

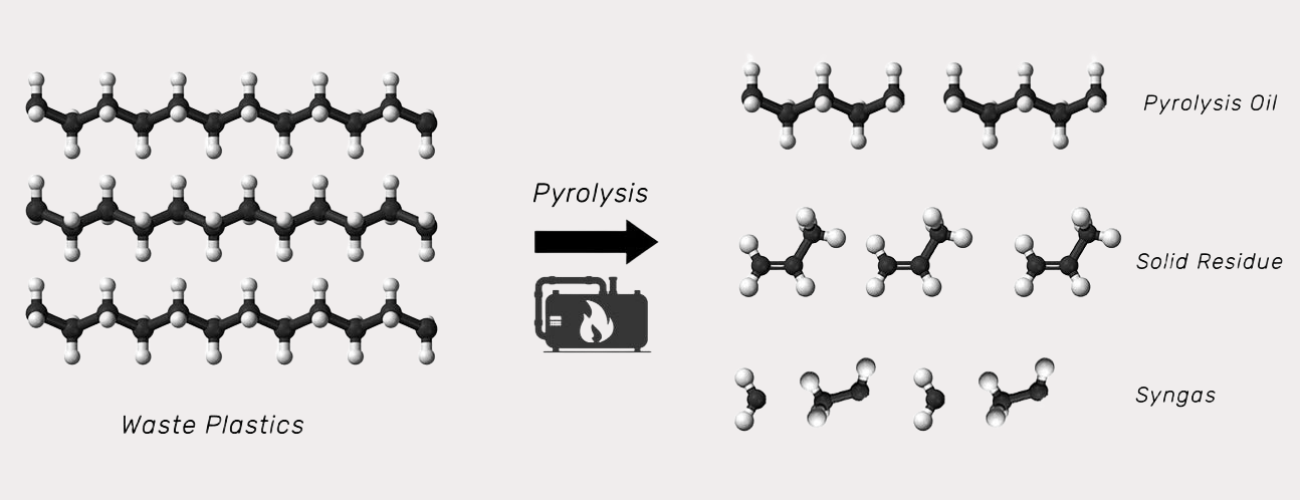

Plastic pyrolysis is emerging as one of the most scalable and efficient solutions for tackling the plastic waste crisis. This process involves thermally decomposing waste plastics into oil, gas, and char in an oxygen-free environment. Companies implementing the plastic pyrolysis process gain a sustainable pathway to recover raw materials that can re-enter industrial production streams.

As global plastic production continues to exceed 400 million tons annually, traditional recycling methods have struggled to keep up. Chemical manufacturers see pyrolysis as a complementary solution to mechanical recycling, especially for contaminated or mixed plastic waste that would otherwise go to landfill or incineration.

Strategic Drivers Behind Industry Adoption

Several strategic motivations explain why more chemical manufacturers are launching pyrolysis projects. Firstly, global regulations are tightening: the EU, Japan, and the United States have all introduced stricter plastic recovery targets. Secondly, consumer brands are demanding recycled content in packaging materials, driving demand for recycled feedstock derived from pyrolysis oil.

Finally, economic incentives are increasing. The market value of pyrolysis oil—a product of modern plastic pyrolysis machine systems—has risen due to its compatibility with refinery feedstocks and petrochemical production lines. Many companies now see pyrolysis not only as an environmental solution but also as a profitable business model.

Technological Advancements Enabling Scale

Recent innovations have drastically improved the reliability and efficiency of pyrolysis systems. Continuous-feed reactors, automated temperature control, and advanced condensation units help optimize oil yield while minimizing emissions. Equipment manufacturers have played a key role by introducing modular, containerized designs that reduce setup time and capital costs.

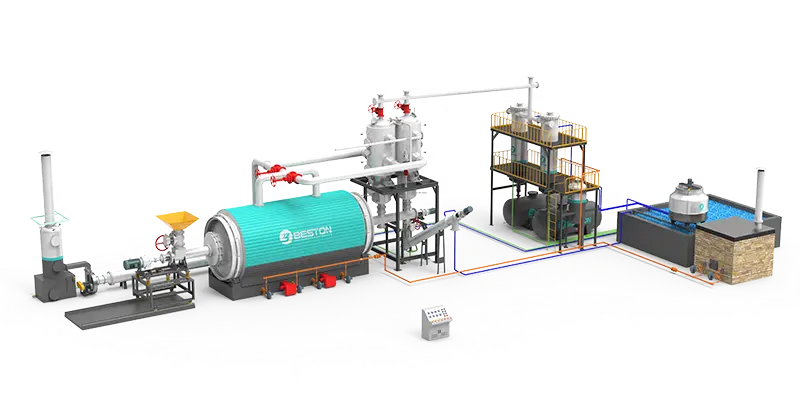

One example of innovation-driven growth comes from suppliers offering customizable equipment solutions, including full-scale conversion systems. For instance, modern systems like the plastic to oil machine enable large-scale operations to transform mixed plastics into refined pyrolysis oil suitable for industrial reuse.

Environmental and Economic Benefits

The benefits of pyrolysis extend beyond the plant gates. Environmentally, it diverts non-recyclable plastics from landfills and reduces greenhouse gas emissions associated with virgin plastic production. Economically, it allows companies to generate additional revenue streams from waste materials while offsetting raw material costs.

For governments and corporations striving to meet sustainability goals, pyrolysis provides measurable impact. Carbon accounting systems can track the reduction in fossil resource consumption, while lifecycle assessments show clear benefits compared with incineration or open dumping.

Collaborations and Industry Partnerships

Large chemical groups are not acting alone. They are forming strategic alliances with waste management companies, equipment providers, and technology developers. Collaboration accelerates project deployment, ensures stable feedstock supply, and enhances public perception.

Among these partnerships, industry players often look to experienced engineering firms for turnkey pyrolysis solutions. One globally recognized name is Beston Group, which provides comprehensive equipment lines, installation guidance, and post-sale technical support. Such partnerships help chemical manufacturers reduce risk and ensure that systems operate efficiently under varied feedstock conditions.

Challenges in Implementation

While the momentum is strong, implementation challenges persist. Feedstock heterogeneity, regulatory approval processes, and logistics of plastic waste collection remain complex. Additionally, the financial viability of pyrolysis projects depends on securing consistent waste streams and maintaining oil quality standards.

To overcome these hurdles, companies are investing in better sorting technologies, digital tracking systems, and pre-treatment units. Continuous R&D is also improving catalyst performance, enabling cleaner and more stable pyrolysis reactions.

Policy Support and Market Signals

Policy frameworks around the world are increasingly favorable to chemical recycling. Tax incentives, grants, and carbon credits are being offered to companies that invest in circular economy projects. By converting plastic waste into fuel or feedstock, pyrolysis facilities can qualify for renewable energy certificates or plastic credit programs.

Market signals reinforce this trend: refineries are now blending pyrolysis oil into conventional crude inputs, and polymer producers are purchasing recycled feedstock to meet brand commitments. The alignment of policy and market demand creates an unprecedented opportunity for chemical manufacturers to lead the way in sustainable materials management.

Steps For Companies Considering Pyrolysis Projects

- Conduct a detailed feasibility study assessing feedstock supply and expected yield.

- Select equipment partners with proven track records in large-scale pyrolysis installations.

- Integrate the pyrolysis unit with existing utility systems for energy efficiency.

- Develop off-take agreements for pyrolysis oil or char to stabilize revenue streams.

- Engage stakeholders early to align sustainability objectives with project outcomes.

Many firms begin with pilot projects using small-scale modular reactors before expanding to full capacity. This staged approach allows them to validate performance data, secure permits, and train operators before major investment.

The Future Of Chemical Recycling

As technology matures, pyrolysis will become an integral part of the global recycling infrastructure. Analysts forecast that by 2030, chemical recycling—including pyrolysis—could handle up to 20% of the world’s plastic waste, reducing dependence on virgin petrochemicals and improving material circularity.

For chemical manufacturers, early participation offers strategic advantages: access to new revenue models, compliance with sustainability regulations, and a stronger market reputation. The industry’s next phase will focus on optimizing integration—where pyrolysis plants work seamlessly with existing refineries and polymer production lines.

Conclusion

The surge of interest in plastic pyrolysis among chemical manufacturers represents a turning point for both industry and environment. With growing technological maturity, supportive policy landscapes, and credible partners like Beston Group, pyrolysis is becoming a mainstream industrial practice. Companies that embrace this innovation now will lead the transition toward circular resource management and a cleaner, more resilient future.

Note: Before investing, companies should evaluate local regulations, feedstock availability, and life-cycle emissions data to ensure that pyrolysis installations align with regional sustainability goals and market requirements.